With a little too much butter and a generous pour of golden syrup. Yum.

With a little too much butter and a generous pour of golden syrup. Yum.

Lately I have been buying a lot of them. I used to buy a pack as a treat now and then, until my usual supermarket had a special.

Usually they are about $1.89 a packet, but they did a special of three for $5. Saving $0.67

So I bought 3.

They must have sold a truckload more crumpets, because the special has been ongoing for weeks now. And I keep buying three for $5. When things go on special, we want to buy more.

Stuff has an article today about how “unpleasant” it will be for KiwiSavers when share prices fall “one day”. The doomsayers have been predicting this scenario for literally years.

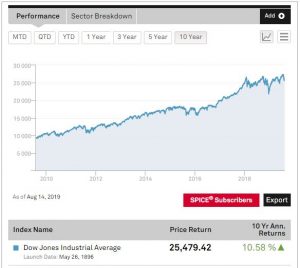

The Dow Jones over 10 years

One day they will be right. And you’ll know about it straight away – you can check your KiwiSaver balance any time, on your phone.

KiwiSaver is more than 12 years old, and has pretty much been on a continuous upwards climb the whole time. So people are used to only seeing their balances go one way. And they might be a little worried when things go backwards.

I’ve never understood why the news media freaks out when that happens. Waitangi weekend 2018 there was a bit of a ‘correction’ while our markets were closed. Come the following Tuesday KiwiSaver balances dropped and the phone lines to some providers were jammed all day. It made the 6 o’clock news and the papers. You might have read about it on your phone.

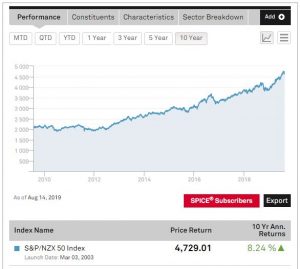

NZX 50 over 10 years

I don’t get it. The prices had dropped. A sale was on. In a shoe shop or a supermarket a price drop is good news. Why treat investing differently?

Look at the charts. Every dip ever eventually turns into a “V” or a “tick” shape. A drop in the price is only a problem if you have something to sell. If you are in KiwiSaver, and you own a house already, then you are a buyer, not a seller.

Like the crumpets on special – when things are cheap, buy more!