Are you protecting your interests, or are you paying to protect your lender?

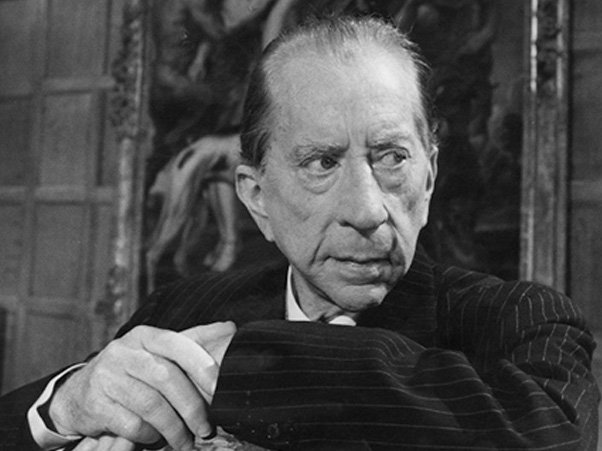

The first American Billionaire, industrialist Jean Paul Getty once said “If you can actually count your money, you don’t have a billion dollars”. I just like that one, because it’s fun.

He also said a quote that resonates with me on many levels: “If you owe the bank $100 that’s your problem. If you owe the bank a hundred million dollars, that’s the bank’s problem.”

One thing I learned during my time in banking is that bankers are clever. They can ‘help’ you solve their problem, because it also seems like you are solving your problem. Not many of us will owe them a hundred million, but we are taking much bigger mortgages these days.

A year ago we moved house. It’s disrupting, it’s exhausting, and it’s expensive. I can’t imagine doing it under any circumstances other than we really wanted a bigger, better home. I certainly wouldn’t want to be forced to sell up and move under duress – such as if one of us was sick, injured or killed and the family could no longer afford to live there.

Buying or changing houses means going through the process of getting a mortgage (I am lucky that I get to practise what I preach and do my own!), which usually leads to somebody suggesting you talk about insurances, among other things that need to be sorted.

If the objective is not “mortgage insurance”, then what is it? It’s “you-get-to-keep-your-home” insurance.

It’s important when going through this process to make sure that your interests and outcomes are planned for and protected. You need to go into debt with a plan to get out of it, and you should have a backup plan for if something goes wrong along the way.

Who is that insurance really meant to protect?

If you owe the bank a large percentage of the value of your house, that’s the bank’s problem as much as it’s yours. This is why having insurance that pays the mortgage if you can’t (sickness, injury) or pays it off if you die does make sense, and it’s why they will often be keen to help you buy some.

But you should also understand that the helpful banker has a target to meet that requires them to sell the bank’s insurances, because for the bank, selling their in-house insurance is very profitable. When I was at the bank the non-mortgage products were more profitable than the mortgage itself! And I’d just like to mention again some still use really nasty exclusions in their fine print.

So I ask: Who is that insurance really meant to protect?

I see a lot of policies that provide only enough cover to pay the mortgage repayments for a short period if you get disabled, or pays just enough life insurance to clear the mortgage (or worse, half!) if you die. But what question do these policies answer? Usually the bank has sold just enough cover to ensure they get paid.

Are you insuring your interests, or are you paying to protect your lender? If the insurance only covers the mortgage, but not food, and rates, and phone and power bills, you still have a major problem.

Your backup plan is your plan. Sure, you will keep paying the mortgage on time, but the plan is serving your best interests by covering your monthly expenses while you’re off work – the mortgage is one of them.

The difference is very simple, but it’s as powerful as it is important.

If you want to go over your policies with an adviser who puts you first, then come and talk to me.